BUDGET 2022-2023

The National Assembly approved the Finance Bill 2022 with certain amendments proposed therein and after the assent of the President of Pakistan, Finance Act, 2022 has been enacted on 30 June 2022.

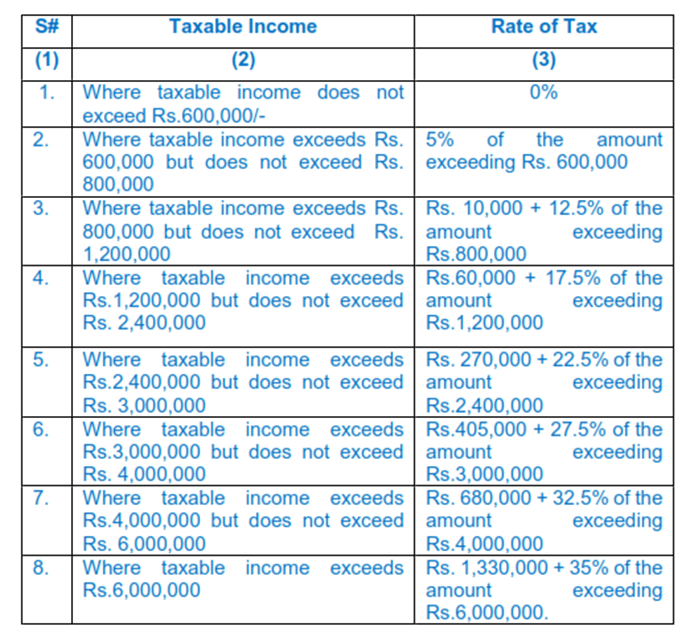

Rates of Tax for Individuals and Association of Persons

In the budget for the fiscal year 2022-23, the government has enhanced the exempt slab rate from PKR 400,000 to PKR 600,000.

Additionally, the government has issued a revised list of income tax slabs and increasing the exempt tax slab for individuals and AOP.

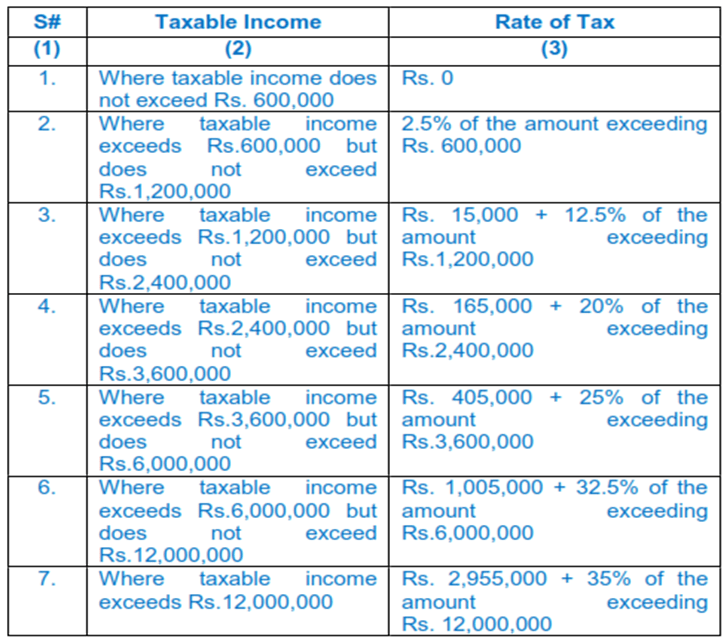

Rate of Tax For Salaried Person

In the budget for the fiscal year 2022-23, the government has reduced the tax rate from 5% to 2.5% upon monthly income above PKR 50,000/- to PKR 100,000/- income slab.

Additionally, the income of an individual chargeable under the head “salary” exceeds seventy-five per cent of his taxable income, the rates of tax to be applied shall be as set out in the following table, namely.

Tax On IT-Enabled Exported Services

After Certain changes have been enacted from 1st July 2022 onward. The previous tax exemption provision has been removed by FBR Pakistan.

The FBR issued Income Tax Circular No. 15 of 2022/2023 to explain the important amendments brought through the Finance Act, 2022 to the Income Tax Ordinance, 2001.

The revenue body said that a special regime u/s 154A of the Income Tax Ordinance, 2001 for export of IT and IT enabled services was introduced though Finance Act, 2021 whereby 1 per cent final tax was collected on realization of export proceeds of these services.

Moreover, hundred percent tax credit was available against this final tax to the exporters of IT and IT enabled services u/s 65F upon fulfilling few conditions mentioned therein.

In order to simplify the tax regime for exporters of IT and IT enabled services, the 100 per cent tax credit regime under section 65F of the Ordinance has been withdrawn and a reduced rate of final tax of 0.25 per cent has been provided for exporters of IT and IT enabled services who are registered with the Pakistan Software Export Board (PSEB).

Income Tax Ordinance, 2001, characterizes two types of IT services that are eligible for 100% tax credit as follows:

IT SERVICES

IT services include but are not limited to the following:

- Web Design

- Network Design

- Software Maintenance

- Software Development

- Web Development

- Web Hosting

- System Integration

IT ENABLED SERVICES

IT services include but are not limited to the following:

- HR Services

- Telemedicine Centers

- Accounting Services

- Data Entry Operations

- Locally Produced Television Programs

- Insurance Claims Processing

- Inbound or Outbound Call Centers

- Graphics Design

- Remote Monitoring

- Medical Transcription

Tax Reduction In Behood Certificates

Profit from investment in Behood savings certificates, pensioners benefit accounts, and Shuhada family welfare accounts are taxed at a maximum rate of 10%. In order to provide further relief to pensioners, it shall be taxed at a maximum rate of 5%.

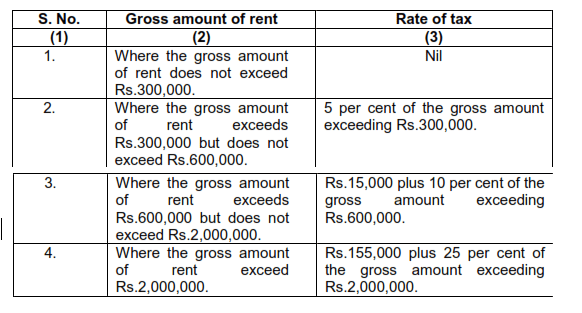

Tax on Immovable Property Rental Income.

The person who has more than one immovable property exceeding Rs.25 million situated in Pakistan shall be deemed to have received rent equal to 5% of the fair market value of the immovable property and shall pay tax at the rate of 1% of the fair market value of the said property.

However, rental properties where calculated income tax is equal to or above as mentioned in this section, self-owned business premises are used for business activity, self-owned agricultural land used for agricultural activity, Registered land development, and construction projects of builders.

Slab rates for rental income are the same as the previous tax year. The rate of tax to be deducted under section 155, in the case of individual and association of persons, shall be

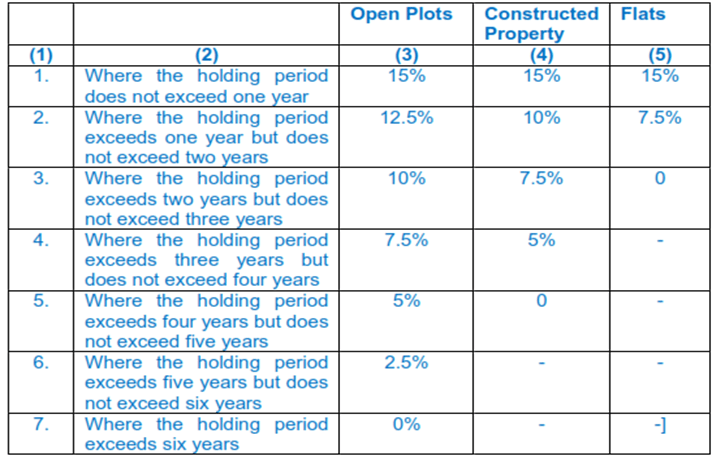

Capital Gain Tax on Immovable Property

Capital gain payable on such assets will reduce to zero after a holding period of 6 years, reducing tax liability by 2.5 % with each subsequent year.

The rate of tax to be paid shall under sub-section (1A) of section 37 shall be as follows:

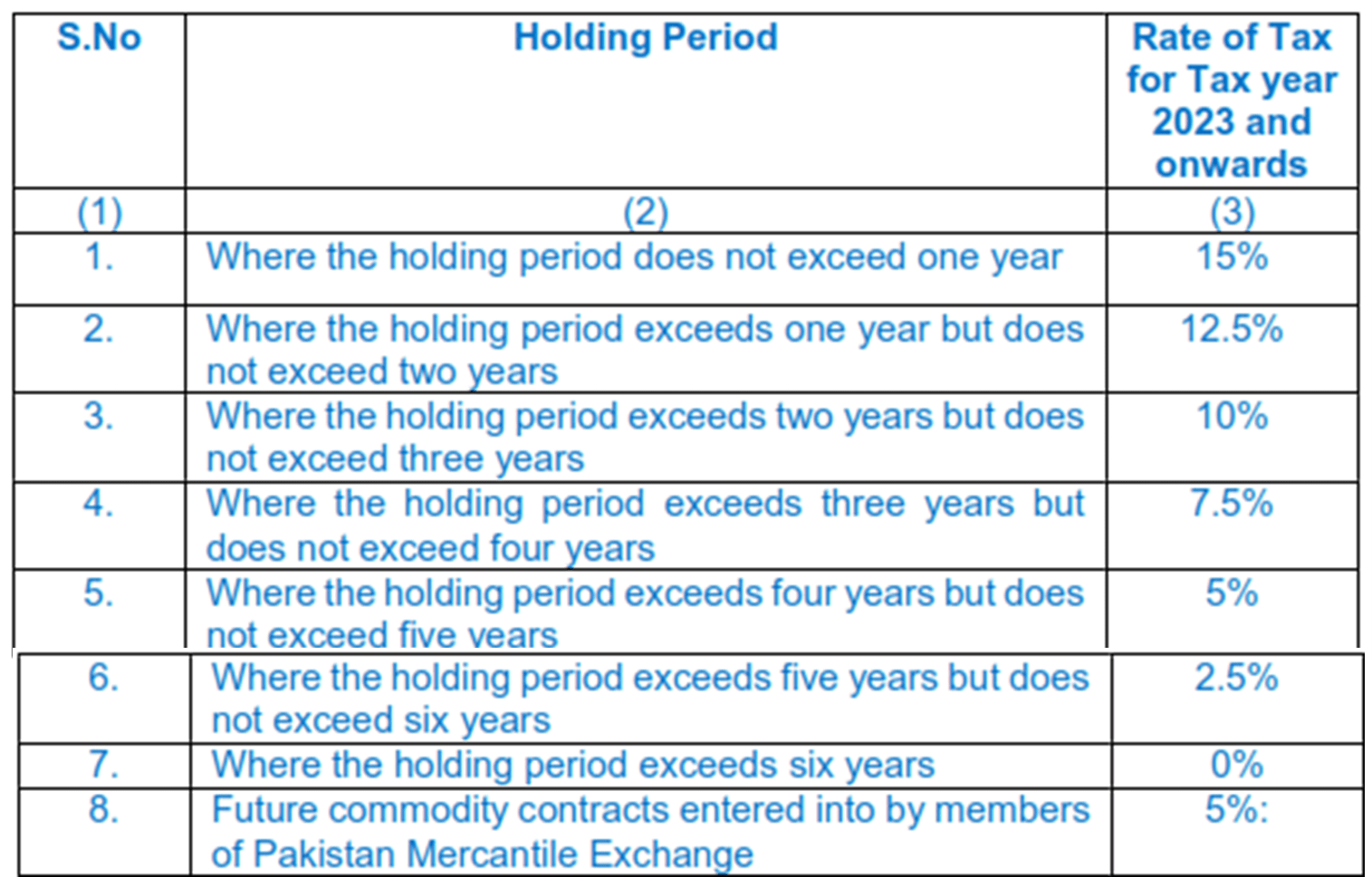

Capital gain on Securities

Gain on disposal of listed securities (that was previously chargeable to tax @ 12.5% irrespective of the holding period) shall now be subject to revised tax rates based on holding period, for securities purchased post July 1, 2022. The revised rates are as under:

Advance Tax of Purchase and Sales of Immovable Property

Advance tax rate for buyer and seller of immovable property is enhanced from 1% to 2%. Except for overseas Pakistanis, the rate shall be increased to 4% for seller and 5% for buyer in case they are inactive taxpayers. Further, advance tax on sale of immovable property is to be collected irrespective of the holding period (earlier it was not collected where property was sold after four years

Advance Tax on Private motor vehicles

Advance Tax on Private motor vehicles, u/s 231B (1), shall be deducted. When registration of a motor vehicle made by the motor vehicle registering authority of the Excise and Taxation Department. At the rates specified:

Motor vehicle registration fee included withholding tax applies within following slabs.

|

Engine Capacity |

Filer |

Non-Filer |

|

Up to 850cc |

PKR 10,00/- |

PKR 20,000/- |

|

851cc to 1000cc |

PKR 20,000/- |

PKR 40,000/- |

|

1001cc to 1300cc |

PKR 25,000/- |

PKR 50,000/- |

|

1301cc to 1600cc |

PKR 50,000/- |

PKR 100,000/- |

|

1601cc to 1800cc |

PKR 150,000/- |

PKR 300,000/- |

|

1801cc to 2000cc |

PKR 200,000/- |

PKR 400,000/- |

|

2001cc to 2500cc |

PKR 300,000/- |

PKR 600,000/- |

|

2501cc to 3000cc |

PKR 400,000/- |

PKR 800,000/- |

|

Above 3000cc |

PKR 500,000/- |

PKR 1,000,000/- |